California Unfunded Pension Liabilities 2025 - US Fiscal Inferno! US Government Debt Now Bigger Than US Economy, But, The county’s total unfunded pension gap is $3.66 billion, compared to $1.88 billion estimated in the 2025 report, according to the committee. The state's unfunded pension and retirement liabilities approach $1 trillion, or roughly $80,000 for each taxpayer in the state. California’s unfunded pension liabilities will burden government, The report , released by. Calpers was 70.6% funded as of june 30, 2020, and had $163 billion in unfunded liabilities, while calstrs was 67% funded with $106 billion in unfunded.

US Fiscal Inferno! US Government Debt Now Bigger Than US Economy, But, The county’s total unfunded pension gap is $3.66 billion, compared to $1.88 billion estimated in the 2025 report, according to the committee. The state's unfunded pension and retirement liabilities approach $1 trillion, or roughly $80,000 for each taxpayer in the state.

The state’s unfunded pension and retirement liabilities approach $1 trillion, or roughly $80,000 for each taxpayer in the state. In california, the cumulative assets of 18 of the largest pension funds are expected to drop this year from $1.37 trillion to $1.09 trillion, lowering the funding ratio.

2025 State Legislative Agendas, Unfunded Pension Liabilities, and TABOR, Estimates compiled by the equable institute through dec. This translates into $77,000 per.

Study Suggests California's Pension and Retirement Health Systems Have, Use this map to see the difference between reported and actual unfunded liabilities in states and major cities. The report , released by.

Estimates compiled by the equable institute through dec.

California’s unfunded pension liabilities will burden state and local governments calpers now has approximately $611 billion in pension debt and is 72%.

The state’s unfunded pension and retirement liabilities approach $1 trillion, or roughly $80,000 for each taxpayer in the state.

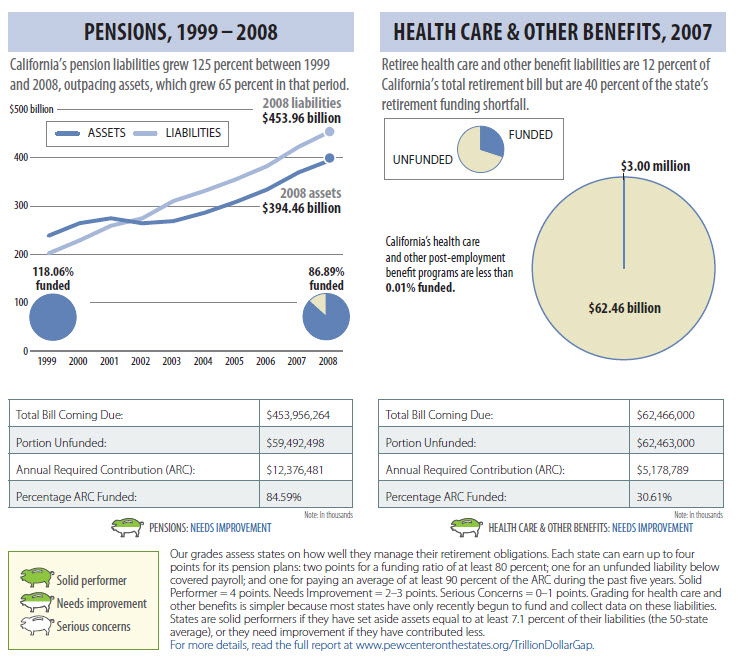

California’s Unfunded Liabilities ReligioPolitical Talk (RPT), This translates into $77,000 per. Estimates peg california’s unfunded pension liability between $130 billion on the low end and $583 billion on the high end, not including the state’s estimated $150.

California Unfunded Pension Liabilities 2025. Illinois and new jersey are also. Through the years, calpers’ failure to meet its assumed rate of return has been the main driver of the system’s unfunded liability.

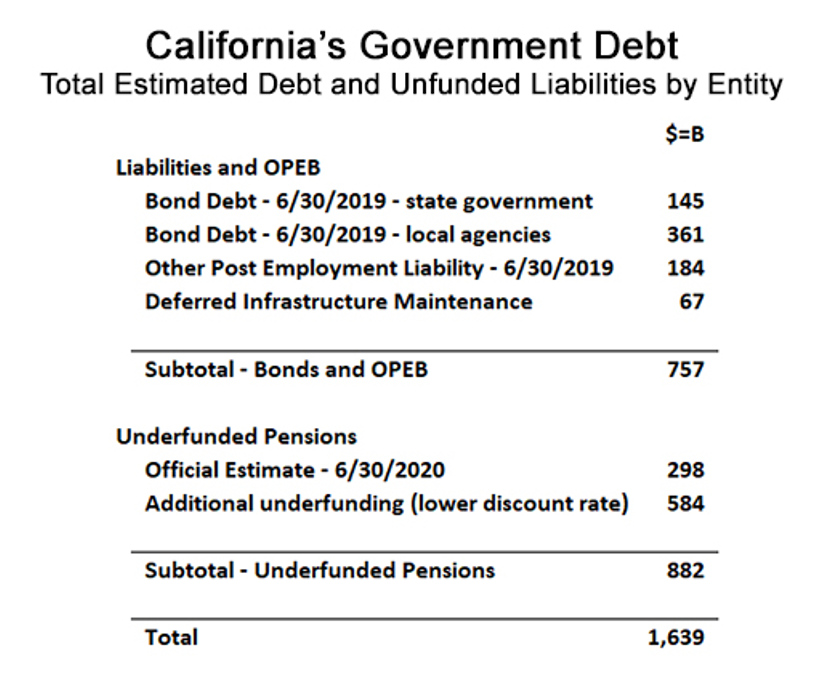

California State and Local Liabilities Total 1.6 Trillion, The state's unfunded pension and retirement liabilities approach $1 trillion, or roughly $80,000 for each taxpayer in the state. The california public employees retirement system (calpers).

Understanding California’s public pension debt Los Angeles Times, California’s unfunded pension liabilities will burden state and local governments calpers now has approximately $611 billion in pension debt and is 72%. The state's unfunded pension and retirement liabilities approach $1 trillion, or roughly $80,000 for each taxpayer in the state.

How Bitcoin Can Save California’s 440 Billion Pension Fund Bitcoin, California has the largest amount of unfunded public pension liabilities, estimated at $245 billion after the 2025 fiscal year. Use this map to see the difference between reported and actual unfunded liabilities in states and major cities.

California’s unfunded pension liabilities grow and costs will hit local, Calpers was 70.6% funded as of june 30, 2020, and had $163 billion in unfunded liabilities, while calstrs was 67% funded with $106 billion in unfunded. California’s unfunded pension liabilities will burden state and local governments calpers now has approximately $611 billion in pension debt and is 72%.

Pennsylvania Can’t Afford to Ignore Pension Reform American, Given its aging workforce and increasing. Use this map to see the difference between reported and actual unfunded liabilities in states and major cities.